Millions of people in the UK are failing to take basic steps like redirecting post or updating firewalls to protect their identities from criminals, a new survey shows.

Major new campaign reveals growing threat from identity fraud

The results have been published as the City of London Police and partners launch the ‘Not With My Name’ campaign to target the growing threat of identity crime in the UK.

One in four UK adults – 12.275 million people – is believed to have fallen victim to identity crime losing on average £1200 each, with total losses to the UK adult population estimated to be £3.3 billion*.

The campaign will urge people to protect their personal information by creating safe passwords, protecting internet devices, rejecting unsolicited phone calls and emails, and safely storing and disposing of mail. Worryingly, today’s survey shows that many people are not taking these steps:

- Online security - 1 in 3 (34%) do not regularly update their firewall or antivirus software;

- Social media –1 in 3 (35%) do not limit the amount of information they share on social media;

- Safe disposal of documents – 1 in 3 (31%) of people do not shred letters before throwing them away.

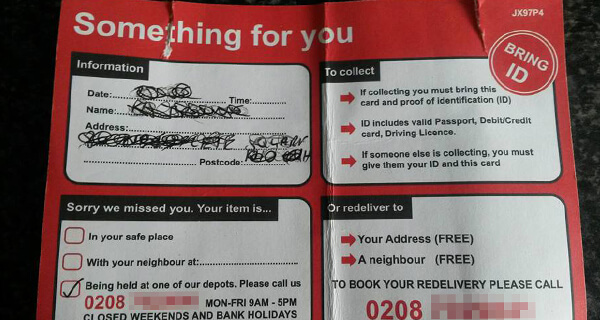

Two thirds of people (71%) do not regularly redirect their post for at least six months when they move house, leaving them vulnerable to bank statements or other mail being intercepted by fraudsters.

There are also age differences. For example, 95% of those aged 65 and over report cutting up old credit and debit cards, compared to just 66% of 18-24 year-olds. Similarly, 83% per cent of those aged 65 and over report shredding letters, compared to just 45% of 18-24 year-olds.

Identity crime is growing in the UK and protecting personal information is essential to combating the threat. In the first quarter of 2015 there was a 27% increase in identity fraud. The average age of a victim of ID fraud is 46, with men being 1.7 times more likely than women to have their identity stolen.

Victims often find that money has been removed from their bank or their account has been taken over, a fraudulent passport or driving license has been created in their name, or loans, mortgages and mobile phone contracts have been set-up using their identity.

Identity crime is distressing for victims and takes an average 200 hours of a person or businesses’ time to resolve. The rise is also concerning because the proceeds are often used to fund further criminal activity.

The ‘Not With My Name’ campaign will share tips to raise awareness and help people protect their identities across the country, with the campaign being supported by 35 local police forces and organisations that include Get Safe Online, Cifas, FFA UK, Age UK and Experian.

A key part of the campaign will be delivered across police force Facebook and Twitter accounts. Additionally on Monday June 29th at 5pm there will be a national Twitter chat, hosted by @actionfrauduk.

City of London Police Commander Steve Head, who is the Police National Coordinator for Economic Crime, said: “Identity crime is a serious issue for the country, with some reports suggesting that as many as one in four adults may have been a victim at sometime, with the potential costs to our economy running into billions of pounds. People across the UK are having their personal information stolen online or even over the phone and often unknowingly. These identities are then used by criminals to commit further criminality, to evade detection from law enforcement and to help launder the proceeds of crime. To really get to grips with identity crime it requires all of us to come together and share advice and best practice on how to most effectively protect our personal information. Following the top tips provided by the ‘Not With My Name’ campaign will help people better understand some of the simple steps they can take in their day-to-day lives that will help keep their identities safe and combat these criminals.”

Simon Dukes, Chief Executive, Cifas said: “Every day across the UK, people are leaving themselves vulnerable to fraud by failing to take simple steps to protect their identities. The good news is that there is so much more we could all do to make a fraudster’s job more difficult. We know that people lead increasingly demanding and busy lives, with many people reporting password fatigue or struggling to find the time to update their software securely and regularly. We need to change the way we think about our identities and prioritise protecting them. ‘Not With My Name’ aims to help us make that a reality and prevent more people from falling victim to fraud.”

Tony Neate, CEO, Get Safe Online said: “Luckily, what we share about ourselves online - especially on social media - is in our own control and keeping things private will make it more difficult for criminals to steal our identity. Something as simple as changing our privacy settings on social media will only take a moment but could protect us from a devastating crime. We also need to be wary of phishing emails or texts that convince us to share personal data, as well as ‘shoulder surfing’ where people look over your shoulder to get hold of log in details. With more of us now accessing things like online banking on our smart phones when we’re out and about, the simple practices of covering our screens and putting a PIN number on our devices shouldn’t be underestimated. This campaign should be a call to action for people to keep their personal information safe online.”

Katy Worobec Director of Financial Fraud Action UK said: “Criminals are after your personal details in order to steal your identity and commit fraud – so it’s important to be alert. If you get a call, text or email out of the blue, don’t reveal any information unless you are absolutely sure who you are dealing with.

“Remember, your bank or the police will never call you to ask for your 4 digit PIN or your online banking password, or for you to transfer money to a new account for fraud reasons – anyone asking you to do so is a fraudster.”

Caroline Abrahams, Charity Director at Age UK said: “A 27% increase in identity fraud should act as a wake-up call to Government and financial institutions that need to stop the un-abating threat of fraud. Figures like this aren’t surprising to us as time and time again we’re seeing stats that highlight this relentless problem. This could get much worse over time as scams get more elaborate and opportunities to defraud vulnerable older people increase. That anyone would target an older person to defraud them in the first place is vile but we know that older people can be especially vulnerable if they are lonely and isolated or suffer with dementia or cognitive decline.

Individuals and businesses that have fallen victim to a fraud facilitated by an identity crime should report to Action Fraud on 0300 123 2040 or at www.actionfraud.police.uk.

*National Fraud Authority Annual Fraud Indicator 2013

Notes to editors

1. Case study:

Sarah, 31, from Leeds, came very close to becoming a victim of identity crime. She had noticed a stranger hanging around the communal mailbox in her building and a couple of days later she received notification that someone had attempted to take out an £8,000 loan in her name. Soon after this she received an application pack from another lender that was ready to issue her with a £10,000 loan. By contacting her bank and the lenders Sarah was able to close down the applications. She also contacted a credit reference agency and had her details added to the Cifas protective register for 12 months.

2. The tips to protect yourself from identity fraud are:

- Tip 1: Be careful who you give your personal information to and how

- Tip 2: Make it as difficult as possible to crack your personal passwords

- Tip 3: Always destroy or securely store personal documents

- Tip 4: Don’t respond to unsolicited phone calls or emails

- Tip 5: Protect your personal devices

3. The ‘Not With My Name’ campaign also coincides with the introduction of new legislation which has been put in place to prevent criminals producing false identity documents using industrialised printing equipment. The Specialist Printing Equipment and Material (Offences) Act 2015 will enable police officers to arrest people who supply specialist printing equipment to criminals, making it harder for criminals to operate.

4. The survey on take up of security measures was conducted by ComRes on behalf of Cifas. ComRes interviewed 4,061 GB adults online between 25th February and 1st March 2015. Data were weighted to be representative of all GB adults aged 18+. ComRes is a member of the British Polling Council and abides by its rules.