Identify fraud continues to be a significant issue in law enforcement with new figures from Cifas.

- Record 89,000 cases recorded in first six months of year by Cifas

- Sharp rise in identity fraudsters applying for loans, online retail, telecoms and insurance products.

- Identity fraud now accounts for 56% of all fraud reported by Cifas members, of which 83% was committed online.

Cifas, the UK’s leading fraud prevention service, has released new figures showing that identity fraud has continued to rise at record levels in the first six months of 2017. A record 89,000 identity frauds were recorded, up 5% from last year.

Although the number of identity fraud attempts against bank accounts and plastic cards has fallen these still account for more than half of all identity fraud cases.

How fraudsters operate

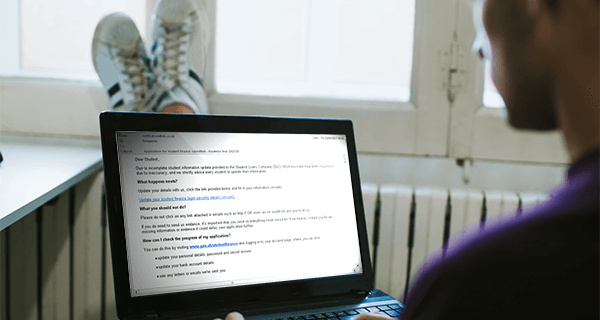

The vast majority of identity fraud happens when a fraudster pretends to be an innocent individual to buy a product or take out a loan in their name. Often victims do not even realise that they have been targeted until a bill arrives for something they did not buy or they experience problems with their credit rating.

To carry out this kind of fraud successfully, fraudsters need access to their victim’s personal information such as name, date of birth, address, their bank and who they hold accounts with. Fraudsters get hold of this in a variety of ways, from stealing mail through to hacking; obtaining data on the ‘dark web’; exploiting personal information on social media, or though ‘social engineering’ where innocent parties are persuaded to give up personal information to someone pretending to be from their bank, the police or a trusted retailer.

Head of the City of London Police’s Economic Crime Directorate, Detective Superintendent Glenn Maleary, said:

“Identify fraud continues to be a significant issue in law enforcement and the new figures which Cifas has released today come as no surprise. The more our lives move online the easier it becomes for fraudsters to steal our identity. It has become normal for people to publish personal details about themselves on social media and on other online platforms which makes it easier than ever for a fraudster to steal someone’s identity.

“We urge consumers and businesses to be conscious of identify fraudsters and to use our protection advice to help stop them in their tracks. We continue to work with banks, retailers and other members of industry to disrupt fraudsters activity however we also realise it is our responsibility to help advise consumers and businesses around these types of issues. We urge anyone who is interested in finding out about the latest fraud trends to sign up to our Action Fraud alerts.”