Fraudsters attempting to steal peoples bank cards and Pin codes while they are using cash machines have tripled over the past year, according to Financial Fraud Action UK.

There were 7,525 incidents in the first four months of the year, compared with 2,553 in the similar period in 2012 with numbers increasing every month.

The reason for this increase is partly because of the introduction of more secure chip-and-pin cards and better designed cash machines, forcing fraudsters into tried and tested distraction techniques. The innovations also make it harder for fraudsters to use hi-tech equipment to copy details on cards.

The way fraudsters steal people’s cards and Pin is a method called “shoulder surfing”. This is when thieves look over a person's shoulder while they key in their number at cash machines and then distract them as the card comes out of the ATM - stealing it.

Prevention advice from Police is to shield the Pin code pad while entering your number, with an object or your spare hand.

Financial Fraud Action UK, an industry body responsible for co-ordinating the prevention of card and payments fraud publicised the data from Vocalink the company that operates the UK's national payments infrastructure.

For further information visit the Financial Fraud Action UK website.

Please note that Action Fraud is not responsible for the content of external websites.

To report a fraud and receive a police crime reference number, call Action Fraud on 0300 123 2040 or use our online fraud reporting tool.

Related links

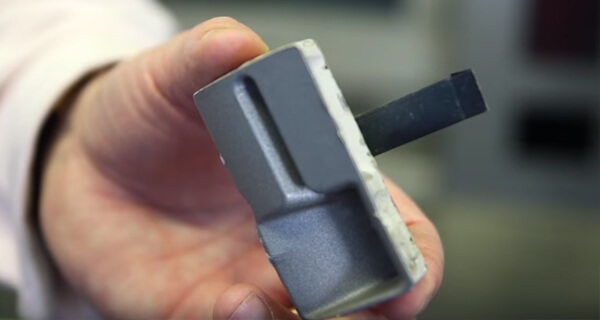

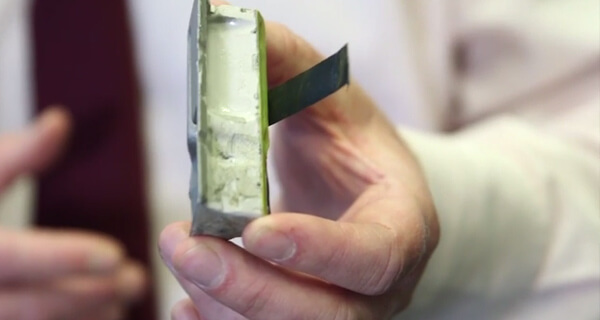

Beware - new variation of courier fraudFraudsters jailed after “Lebanese loop” scam