Fraud at ATMs is rare but it is important all cardholders are aware of the importance of covering their PIN and staying safe at a cash machine.

The most common types of incident at an ATM are card entrapment and card skimming. To trap a card, fraudsters insert a device into the machine to prevent a card from being ejected. The fraudster then removes the card once you have left the ATM.

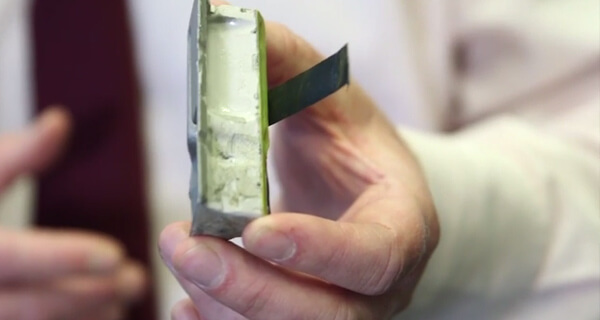

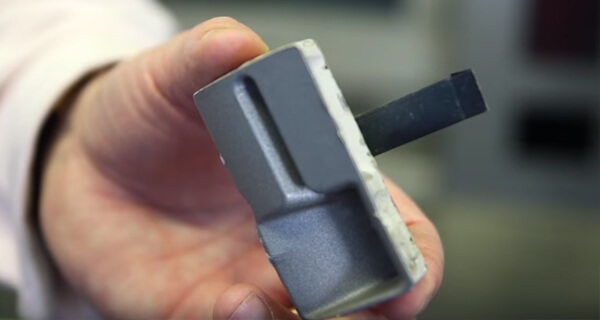

To skim a card, fraudsters insert a device into an ATM which will copy the magnetic stripe details from your card.

So they can make use of your card details, fraudsters must obtain your PIN. To do this they will either watch you at an ATM, known as shoulder surfing, or may use a camera. Therefore, it is very important you cover your PIN at an ATM.

Financial Fraud Action UK recommends the following to stay safe at an ATM:

- Stand close to the terminal. Always shield the keypad with your free hand, purse or wallet, and your body, to avoid anything or anyone seeing you enter your PIN. This will protect your PIN from anyone who might be looking over your shoulder, and also help to keep your PIN safe if a fraudster has set up a hidden camera to film the keypad.

- Stay alert and put your personal safety first. If someone is crowding or watching you, cancel the transaction and alert a member of staff. Do not accept help from seemingly well-meaning strangers and never allow yourself to be distracted.

- Have your card company's 24 hour contact number stored in your mobile phone. If your card is retained, stay at the ATM and contact your bank immediately.

- If you spot anything unusual about the machine, or there are signs of tampering, do not use it.

- If you think you have been a victim of fraud, you should contact your bank immediately.

Generally ATMs are very safe and more than £1 billion is withdrawn from ATMs every month. By contrast, last year £32.7 million was lost to ATM fraud, a very small proportion of the overall amount of money withdrawn.

To report a fraud and receive a police crime reference number, call Action Fraud on 0300 123 2040 or use our online fraud reporting tool.